Purchasing Life Insurance With a Heart Murmur

Many life insurance policies require medical examinations to assess the risk of policyholders.

Many life insurance policies require medical examinations to assess the risk of policyholders.

Having a heart murmur may affect the eligibility for coverage and, in some cases, the life insurance premiums.

But many heart murmurs are innocent and don’t pose any significant health risks.

It is important to understand which type of murmur you have in order to understand the implications it may have on life insurance coverage.

Get a Customized Life Insurance Quote!

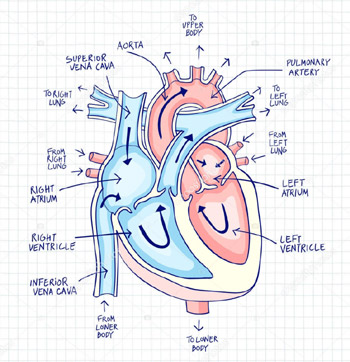

Organic heart murmurs represent problems with valves or other structures within the heart and can be indicative of serious underlying health issues such as congenital heart defects or narrowing of the arteries. Other conditions such as hypertension, an infection or anemia can also cause organic murmurs.

Innocent heart murmurs usually have no identifiable cause and are usually harmless. Electronic sound tests or echocardiograms can help identify if a murmur is innocent or organic. In general, life insurance companies view innocent murmurs as less risky than organizational ones and they will typically not increase premiums for clients with an innocent murmur. However, some insurers may require more detailed medical information before providing life insurance coverage regardless of type of murmur.

Typical life insurance policy amounts:

Table of Contents

At a Glance

- Disclose your heart murmur when applying for life insurance.

- Provide any necessary medical information to the insurance company.

- Many life insurance companies are willing to insure individuals with heart murmurs.

- Functional or innocent murmurs may not affect your ability to qualify for coverage.

- Those with more serious heart conditions may have a harder time qualifying or may pay higher premiums.

- Shop around and compare rates from different insurance companies to find the lowest priced policy on the market.

Get Your Own Life Insurance Rates!

Is Your Heart Murmur Organic or Innocent?

Many people have heart murmurs, and these can often fall into two categories - organic or innocent. Knowing what type of heart murmur you have is important for getting the life insurance coverage you need.

- Organic heart murmurs are often a sign of something more serious, such as a damaged heart valve. These can be particularly serious and may require specialized treatments or medications. If you think there may be a possibility that you have an organic heart murmur, it's important to discuss this with your doctor and explore the possible treatments or medications available.

- Innocent or functional heart murmurs are much more common and may not require any treatment at all. It's also quite likely that if you have an innocent heart murmur, it will eventually subside over time. Innocent heart murmurs often do not cause any symptoms and typically do not interfere with your ability to live a healthy lifestyle.

When looking to purchase life insurance, it is worth informing your insurance provider of any findings regarding your heart health so that they can work out the best plan sure for you.

They may also ask for additional testing from your doctor to confirm whether or not your heartbeat is considered normal - even if it happens to include some form of murmur. Rest assured that many people with harmless heart murmurs are still able to get life insurance coverage without issue.

Get Instant Life Insurance Rates!

How Does A Heart Murmur Affect Life Insurance Rates?

Having a heart murmur can affect your life insurance rates, but it doesn't necessarily mean that you will pay more for coverage with your particular kind of murmur.

Most murmurs are considered to be "innocent" and won't significantly raise your premiums. In fact, if you have been diagnosed with a functional heart murmur and show no signs of heart valve disorders or regurgitation, some companies may give you their "preferred best rate".

To qualify for this top rate class, it is likely that the life insurance company will want an ECG test to confirm that the murmur is indeed innocent. The insurer will also generally review and assess any other potential health issues before making their decision. Even if you had a heart murmur as a child but it is no longer present, the insurance company should not hold this against you.

The best way to be certain about what kind of rates you will receive is to apply for life insurance and get a quote. That way, you'll be able to understand exactly how your heart murmur may affect the premiums. It's always important to provide full disclosure when applying for life insurance so that there are no surprises later on down the road.

What Causes Organic Heart Murmurs?

Organic heart murmurs can signal a range of potential heart issues. In many cases, the murmur may be innocent and not necessarily indicative of a more serious issue.

- Mitral Valve Prolapse, for example, is common and in most cases an associated murmur is not serious.

- People with Aortic Sclerosis may experience a thickening or stiffening of the aortic valve which in most cases is not dangerous unless the valve narrows.

- Aortic Stenosis occurs when the aortic valves (on the left side) narrow, placing additional strain on the heart and if left untreated can lead to heart failure.

- Regurgitation (Mitral or Aortic) happens when blood flows backwards through either the mitral or aortic valves which can cause enlargement of the heart and eventual failure.

- Finally, Diastolic and Systolic murmurs are graded on a scale from one to six based on how loud they are and what stage they occur in during the heartbeat respectively.

If you have had a heart murmur detected, it's important to understand what potential cause it has so you can make informed decisions about your life insurance coverage. Most people with innocent murmurs will still be able to apply for life insurance but some insurers may require further tests or exclude certain conditions from their policy coverage. It's important to take time to read policy documentation carefully before making any decisions so you understand exactly what is covered by your chosen insurer.

It's also essential that anyone who has been diagnosed with a potentially serious organic heart murmur seeks medical advice as soon as possible. Without proper treatment, even those with mildly problematic murmurs could find themselves facing health issues down the line due to complications that arise from an untreated condition. Regular check-ups should form part of your long-term healthcare strategy if you are found to have an organic heart murmur so that any changes can be monitored effectively and treated in good time if needed.

Get Your Own Life Insurance Rates!

Questions You'll Be Asked About Your Heart Murmur

As you shop for life insurance, your agent will likely inquire about your heart murmur. Different life insurance companies treat heart murmurs differently, so it's important to be prepared and knowledgeable when filling out the application. Here are some of the questions you may be asked about your heart murmur.

Innocent murmurs are relatively common in young children and generally disappear by adulthood, however, some adults may not fully outgrow them. The underwriter will need to know if the murmur is innocent or there is an underlying cause such as coronary artery disease. If you’ve had any type of surgeries related to your heart condition, the agent will want to know what procedures were done and when.

Angina, palpitations, nausea, and shortness of breath are signs of an organic murmur and could result in a denial of coverage. If you don’t experience any symptoms from your murmur, then it is likely innocent and won’t prevent you from qualifying for preferred or preferred best rates. Most life insurance carriers will want to see that the innocent diagnosis is confirmed by an echocardiogram. Also, regular follow-up visits with your primary care doctor or cardiologist may be necessary to monitor your condition.

If you are taking medications for your heart murmur or any other conditions, it’s important to have a list on hand when speaking with your life insurance agent. Innocent murmurs typically do not warrant medication; however, informing the underwriter of any medications taken is still useful information. Knowing what questions you can expect beforehand can save time and money on finding the right policy for you.

Closing Remarks

Securing life insurance with a heart murmur can be a challenge, but it doesn't have to be overwhelming. We provide the answers to the questions you'll be asked and the information you need to understand how a heart murmur affects your rates.

Giving full disclosure when applying for life insurance is vital. It ensures the company can accurately assess the risk and guarantee coverage is secure and cost-effective. While you may face higher premiums, there are various policies that work with your budget and meet your needs.

Do your research and shop around for the best value. Compare quotes from different companies and weigh the features of each policy. This makes sure you get the most affordable life insurance.